New 2026 Tax Limits (brackets, deductions, LTCi limits, etc.)

Claude Thau

10/11/2025 · 1 min read

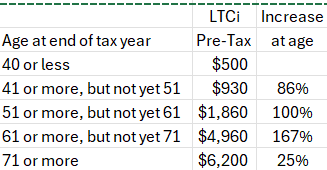

Click here for 2026 tax limits. Qualified LTCi premiums paid for owners and their spouses are tax-deductible to employers and generate NO taxable income for owner-employees up to the following premiums in 2026 when paid by sole proprietors, S-Corps, LLCs, limited partnerships or other entities whose earnings are taxed on their owners’ tax returns. These limits are indexed, hence increase annually for in force policies.

When such entities pay LTCi premiums for non-owners and their spouses, the FULL amount generally generates NO taxable income for the employee.

When entities that pay taxes directly to the Federal government (such as C-Corporations) or non-profits pay LTCi premiums, the FULL amount generally generates NO taxable income for the employee.

LTCi BENEFITS are generally tax-FREE up to the GREATER of the qualified expenses or $430/day in 2026.

If you don’t have a BackNine Quote & Apply website, get your free website in less than a minute by registering here.

Please note: I am not an advisor relative to tax or legal issues. I share my understanding of laws solely to help clients determine whether tax or other legal issues might be significant to a decision regarding LTCi. If so, clients should rely on the advice of a tax or legal professional. I am to discuss these issues with a client’s professional advisor.