BackNine's Top MYGA and FIA Rates - Week of January 26th, 2026

Matt Gozdecki

9/22/2025 · 1 min read

Even with savings accounts and short-term Treasuries offering around 4%, many clients are realizing those returns barely outpace inflation—and that’s before taxes. That’s why forward-thinking advisors are repositioning idle cash into Multi-Year Guaranteed Annuities (MYGAs) and Fixed Indexed Annuities (FIAs)—solutions that offer safety, growth potential, and long-term efficiency.

Why advisors are making the move:

- Higher guaranteed yields: MYGAs often pay more than CDs or Treasuries of similar duration—without market risk.

- Tax-deferred compounding: Let interest grow untouched until it’s needed, amplifying long-term results.

- Principal protection: Clients’ money is shielded from market downturns while still earning meaningful returns.

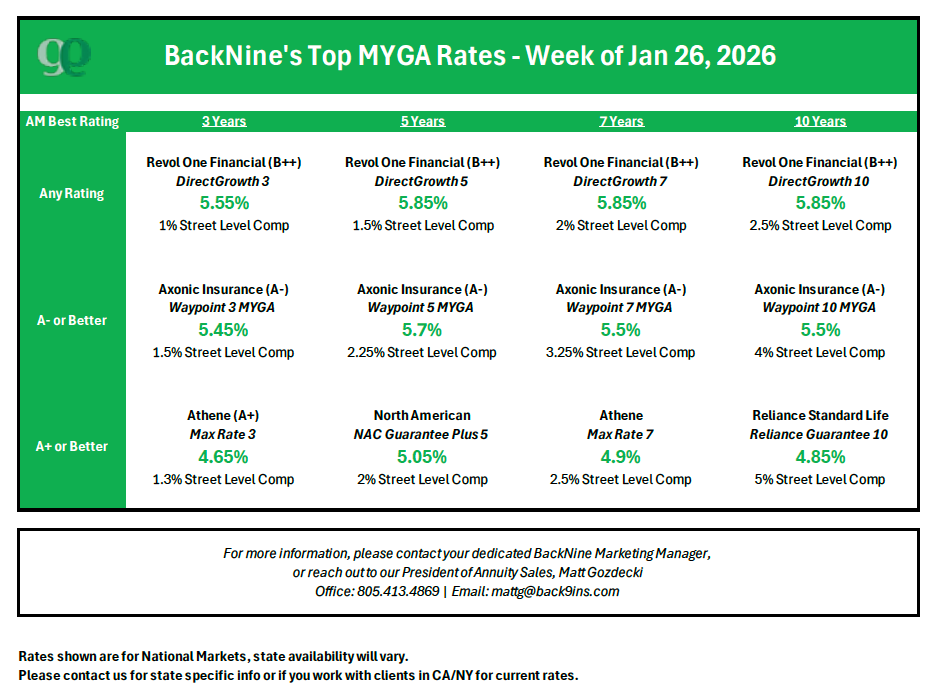

BackNine’s MYGA Hot List - National Markets - Week of Jan 26, 2026

BackNine’s MYGA Hot List - CA Only - Week of Jan 26, 2026