BackNine's Weekly MYGA Highlights, 1/12/2026 - Top Fixed Rates from 2-10 Years

Matt Gozdecki

6/9/2025 · 1 min read

With the Fed cutting rates three times in 2025 and top savings accounts now hovering around 3.5–4.5% APY, savers looking to lock in guaranteed growth are running out of runway. CDs are trending lower, money market rates are slipping, and that window of opportunity is narrowing fast.

But there’s good news: Multi-Year Guaranteed Annuities (MYGAs) are still offering highly competitive fixed rates—with the added benefit of tax-deferred growth. If you’re looking to protect your clients’ savings from further rate erosion while securing predictable, guaranteed returns, now is the time to explore what MYGAs can do.

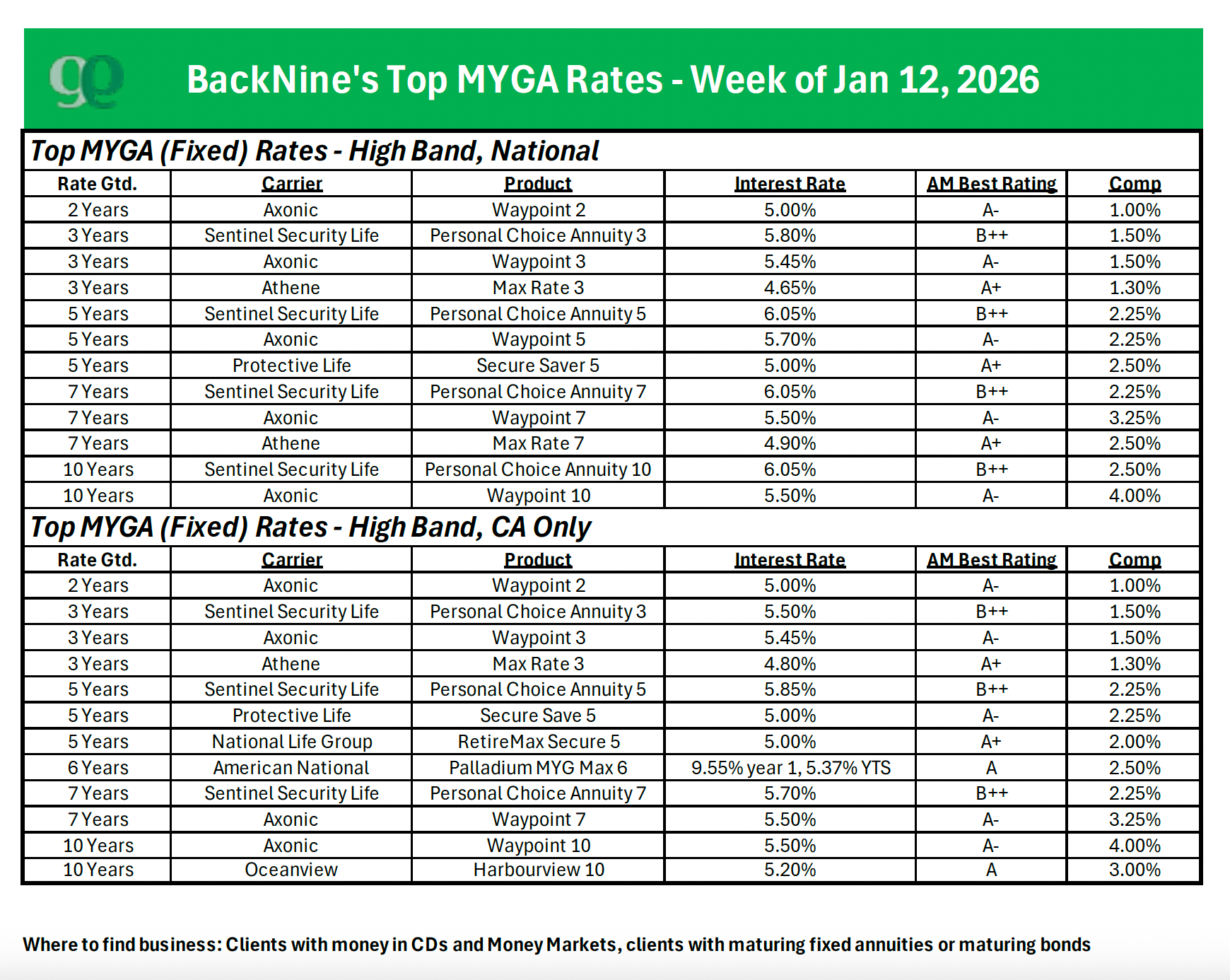

Take a look at our top guaranteed rates from 2-10 years, or download our full industry reports by clicking the links below!

Click here to download BackNine’s MYGA Hot List, National Markets - week of Jan 12, 2026

Click here to download BackNine’s MYGA Hot List, California - week of Jan 12, 2026