Fed Cuts Rates — But Your Clients Don’t Have To Settle for Less

Matt Gozdecki

10/29/2025 · 1 min read

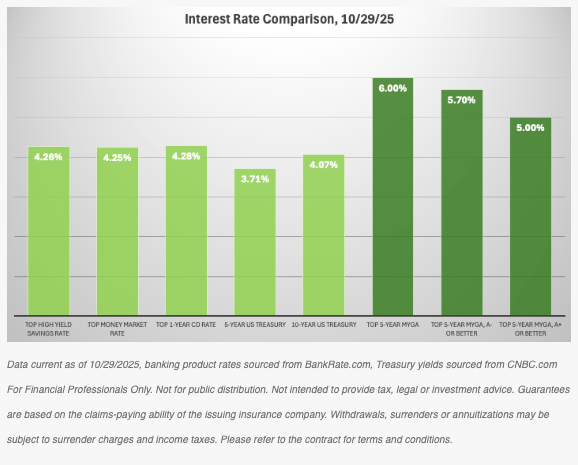

With today’s Fed rate cut, the “safe money” landscape just got a little murkier. As banks scramble with lower deposit yields and Treasury rates inch downward, your clients still need reliable places to park capital—where yield, certainty and tax efficiency matter.

Enter the multi-year guaranteed annuity (“MYGA”): a fixed-rate contract that locks in a guaranteed crediting rate for 2-10 years, provides tax-deferred growth, and avoids the market risk of equities.

Compared to jumbo CDs, money-market funds or Treasuries, MYGAs can deliver:

- A higher interest rate environment (industry spot rates for 3- to 5-year MYGAs are meaningfully above comparable CD or Treasury yields)

- Tax-deferred compounding (versus annual taxation on CDs)

- A guarantee of rate for the term (versus floating or reset risk in Treasuries or money-market funds)

In short: when the Fed takes its foot off the pedal, it’s time to help your clients lock in the opportunity rather than chase the next surprise move. Let’s talk about how MYGAs can become a key “safe-money” sleeve for your clients’ portfolios.

BackNine’s MYGA Hot List - National Markets - 10/29/2025

BackNine’s MYGA Hot List - CA Only - 10/29/2025