How to Create an Impaired Risk Quote

Reid Tattersall

10/19/2022 · 1 min read

When clients have medical, financial, citizenship, or other issues, it’s suggested to pre-underwrite their issues so you can accurately quote at the correct rate class. Mis-quoting your client can create inaccurate expectations of the cost of insurance and ultimately create a longer and more problematic experience. The impaired risk quote process refers to providing an anonymous summary of information to insurance carriers and having them respond with their particular underwriting offer. Using each carriers’ offer, you can quote each carriers’ product and deliver a more accurate premium.

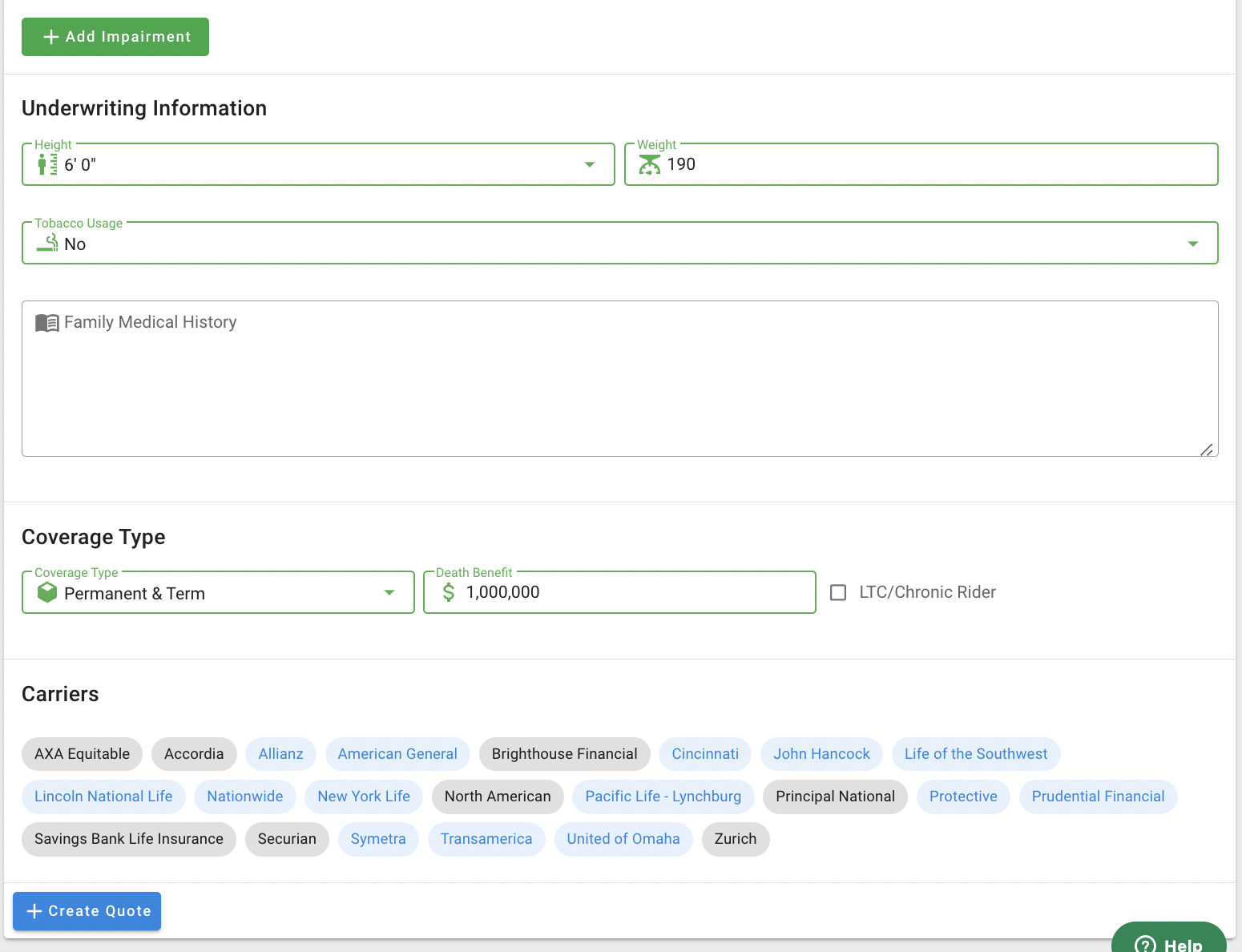

The Impaired Risk Quote wizard will gather your client’s information, impairments, case design, and ultimately allow you to choose the carriers to send the information to.

Here’s how you can create an Impaired Risk Quote:

Click Create Impaired Risk Quote

Once finished, carriers will respond to your inquiries individually. You’ll be emailed the responses and can also log into BOSS to view a summary of all of the offers. Carriers usually respond within 48 hours.

Is this an informal inquiry? No, an informal inquiry refers to a process where BackNine obtains a HIPAA authorization from your client which enables us to order the client’s medical records. Once the records are received, they are sent to the insurance carriers for review. Informal inquiries take significantly longer but ultimately provide a more accurate underwriting offer. In general, informal inquiries require a premium size of at least $10,000/year as carriers prefer to not spend their resources evaluating medical records on smaller and less profitable opportunities.